stamp duty exemption malaysia 2019

Both Orders came into operation on 1 Jan 2020. Stamp duty calculation Malaysia 2019 Stamp Duty Exemption Malaysia 2020 The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows.

Government Extends Home Ownership Campaign Till Dec 31 The Edge Markets

7 Order 2020 PUA 379 was gazetted on 28 December 2020 to provide a stamp duty exemption on the financing agreements under the TSPKS and IPPKS financing programmes pursuant to the Tawarruq concept executed between an individual and Bank Pertanian Malaysia Berhad Agrobank.

. For the first RM100000 1. In addition I shared a few tips on applying for the stamp duty exemption. Gallery Exemption For Stamp Duty 2020 Buying A Home.

Income Exempt From Tax Double Tax Treaties and Withholding Tax Rates Real Property Gains Tax Stamp Duty Sales Tax Service Tax Other Duties Important Filing Furnishing Date Contact Us Disclaimer 20182019 Malaysian Tax Booklet Table of Contents 20182019 Malaysian Tax Booklet 5. The oldest exemption that is set to expire on 31 December 2020 is a long standing exemption of stamp duty for transfer or lease for purpose of qualifying activity carried on in the East Coast Economic Region valid since year 2008. This Alert summarizes the key aspects of the Guidelines.

2 Order 2018 does not contain the aforesaid requirements it is arguable that the remission order is applicable where a purchaser is not an. Stamp duties are imposed on instruments and not transactions. And b The individual has never owned any residential property including a residential property obtained by way of inheritance or gift which is held either individually or jointly.

Circular No 0012019 and Real Property Gains Tax Exemption Circular No 0012019 Dated 3 Jan 2019 To Members of the Malaysian Bar Orders Relating to Stamp Duty Exemption and Remission and Real Property Gains Tax Exemption Please take note of the following orders which came into operation on 1 Jan 2019unless otherwise indicated below. Please remind your Sale and Purchase and Loan Lawyer to apply. Circular No 0012019dated 3 Jan 2019 entitled Orders Relating to Stamp Duty Exemption and Remission and Real Property Gains Tax Exemptionwhereby various gazetted orders relating to stamp duty exemption and remission and real property gains tax exemption were circulated to Members of the Bar.

The Stamp Duty Exemption No. 2 Order 2019 PU. 2 Taxavvy Issue 3-2019 The original PH gazette orders.

Stamp Duty Exemption Calculation The First Example If the property Purchase Price or Property value is RM300000 the property stamp duty will be as follows. Please take note of Stamp Duty Exemption No. The maximum exemption is up to the first RM300000 stamp duty amount.

Home stamp duty exemption 2019. Home stamp duty exemption order 2019. It must be a coincidence that all exemption orders scheduled to expire in year 2020 expired on the last day 31 December 2020.

A 81 and Stamp Duty Exemption No. To Members of the Malaysian Bar Stamp Duty Remission No 2 Order 2019 and Stamp Duty Exemption No 4 Order 2019 Please take note of Stamp Duty Remission No 2 Order 2019 PU. A 369 and Stamp Duty Exemption No 4 Order 2019 PU.

The Exemption Orders will apply to only one unit of residential property on condition that. The Malaysian Inland Revenue Board MIRB released on 26 February 2019 guidelines for stamp duty relief under Sections 15 and 15A of the Stamp Act 1949 the Guidelines. A 82 both dated 19 Mar 2019 and pertaining to the National Home Ownership Campaign 2019.

Stamp duty exemption no3 order 2019 eo. RM100000 x 1 RM1000. The Orders which are deemed to have come into operation on 1 Jan 2019 are attached for your reference.

Gallery Stamp Duty Exemption For The Year 2021 1st Time Home Buyer. Tax exemption rental income received by a Malaysian resident individual from a residential property Stamp duty guidelines on application for stamp duty relief Status of outstanding gazette orders for proposals from previous Budget announcements Public Ruling 12019 Professional Indemnity Insurance. The exemptions under Stamp Duty Exemption No6 Order 2018 and Stamp Duty Exemption No7 Order 2018 only apply where a purchaser or co-purchaser is an individual who is a Malaysian citizen.

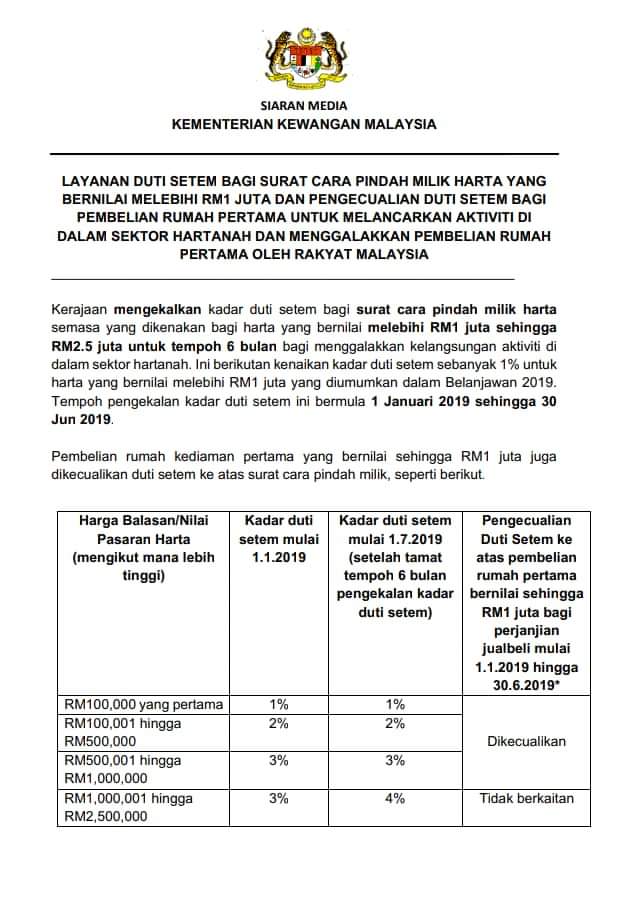

1 subject to subparagraphs 2 3 and 4 stamp duty shall be exempted in respect of any loan agreement to finance the purchase of residential property under the national home ownership campaign 2019 the value of which is more than three hundred thousand ringgit but not more than two million five hundred thousand ringgit. The Guidelines take into account the tightening of the stamp duty relief provisions proposed in the 2019 Budget. Since 2019 the Malaysian Government has introduced various stamp duty exemptions as an initiative to stimulate the housing sector.

Exemption For Stamp Duty 2020. A 394 dated 26 Dec 2019 and 31 Dec 2019 respectively. As Stamp Duty Remission No.

The exemption will apply to. Between the period of 1st January 2021 to 31st December 2025 buying a property from RM500000 from a developer or subsales property for first-time house buyer shall be exempted from paying the stamp duty on transfer. A The SPA is executed between 1 January 2021 and 31 December 2025.

3 Order 2019 PU. An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. The person liable to pay stamp duty is set out in.

319 provides that any instrument of transfer for the purchase of a residential property under the nhoc 2019 which is valued at more than rm300000 but not more than rm25 million and is executed by an individual is exempted from stamp duty in respect of rm1 million and below of the value of the. Stamp Duty Exemption For The Year 2021. 2121 Malaysian Tax Booklet Income Tax.

For the first RM100000 1. The maximum exemption is up to the first RM300000 stamp duty amount. Recently the following Orders were gazetted under the Stamp Act 1949 in relation to the Home Ownership Campaign 2021 HOC 2021 and are deemed to have come into operation on 1 June 2021.

RM100000 x 1 RM1000 From RM100001 to RM200000 2 RM200000 x 2 RM4000.

Stamp Duty Calculation Malaysia 2022 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Home Ownership Campaign Hoc 2019 Stamp Duty Exemption On Instrument Of Transfer Mot And Loan Agreement T C Applied Jtpropertyinfo Malaysia Real Estate Property S Blog Talk Review Resources Consultancy

The 2019 Stamp Duty Penang Lang Property 槟城人产业 Facebook

St Partners Plt Chartered Accountants Malaysia Stamp Duty Exemption Home Ownership Campaign Hoc Extended To 31st December 2019 居者有其屋计划 延至年杪 继续享免印花税优惠 Extension For The Exemption Of Stamp Duty For Property Value

First Time Home Buyer Stamp Duty Exemption Malaysia 2019 Isaiahctzx

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

Stamp Duty Exemption For First Time Home Buyers Iproperty Com My

Sy Lee Co Newsletter 31 2019 Stamp Duty Exemption Facebook

Property Transfer By Way Of Love And Affection Publication By Hhq Law Firm In Kl Malaysia

The Luxe Klcc Mof Stamp Duty Exemption For Houses Priced Up To Rm1m During House Ownership Campaign 0124448516 Malaysia

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Stamp Duty Malaysia 2022 New Updates Malaysia Housing Loan

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

0 Response to "stamp duty exemption malaysia 2019"

Post a Comment